Broadcom’s Business Model Supports Robust Dividend Growth

[ad_1]

NYSE:VMW) for approximately $61 billion in money and inventory. This is one particular of the greatest know-how transactions in historical past and additional blosters Broadcoms computer software products lineup. This follows various transactions, such as CA Technologies in 2018 and Symantec in 2019, about the previous couple of many years that were concluded to increase the firm’s application business enterprise.

VMware experienced been switching to a lot more of a subscription design by itself, something that Broadcom has been pretty profitable at carrying out. The offer, if finished, will necessarily mean that recurring software income will contribute practically 50 % of annual gross sales. These profits are substantially additional predictable even if they expand at marginally decrease costs.

The most current quarterly report coupled with the acquisition of VMware really should empower Broadcom to continue to improve its dividend at a significant fee.

Dividend assessment

Broadcom has elevated its dividend for 11 consecutive several years. Progress has been quite strong as the business has a five- and 10-12 months compound yearly expansion amount of 31.5% and 142%. This occurred even as the share depend virtually doubled in excess of the previous 10 years.

Significant for traders, dividend expansion looks probably to carry on as nicely. Broadcom dispersed $14.40 of dividends for each share in 2021 even though producing earnings for every share of $28. This equates to a payout ratio of 51%.

The organization is projected to distribute dividends for each share of $16.40 for 2022, implying an expected payout ratio of 46%. This compares to the 41% payout ratio that Broadcom has averaged because 2016.

Free of charge cash flow also exhibits a equivalent photo of basic safety. The company has paid out out $1.75 billion value of dividends above the last 12 months. At the similar time, Broadcom generated totally free income movement of $4.2 billion, resulting in a payout ratio of 42%. This is really near to the a few-yr regular of 44%.

Turning to financial debt obligations, Broadcom experienced fascination price of $1.77 billion in excess of the very last year. The company experienced total debt of $39.2 billion at the finish of the 2nd quarter, resulting in a weighted average curiosity amount of 4.5%.

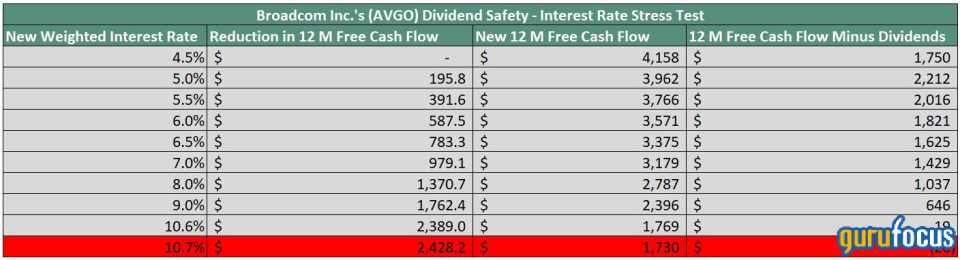

The table under illustrates where Broadcoms weighted normal desire rate would need to arrive at just before dividends had been not covered by the companys no cost income flow.

Resource: Authors calculations.

Broadcoms weighted common desire amount would need to rise higher than 10.6% in advance of dividends were being not adequately lined by free of charge income movement. As such, credit card debt does not look to be a important issue in potential dividend payments.

Shares yield just above 3% currently, very close to the 5-yr typical generate of 3.2% and double the ordinary of the S&P 500 Index.

Valuation

Broadcom at the moment trades in the vicinity of $541, implying a ahead selling price-earnings ratio of 14.7. The stock has a 10-year normal selling price-earnings ratio of near to 14, so shares are currently marginally ahead of its prolonged-phrase average.

The GF Benefit chart demonstrates that Broadcom is reasonably valued on an intrinsic basis.

With a GF Value of $523.41, Broadcom has a selling price-to-GF Value of 1.03, earning the inventory a rating of fairly valued from GuruFocus.

Closing ideas

Broadcoms next quarter outperformed the normal analysts estimate both on the prime and bottom strains. The enterprise experienced advancement in key parts, with the expectation that development would proceed and, in some situations, accelerate in the recent quarter.

The companys report-location acquire of VMware will be a main addition and ought to power Broadcoms software program organization even further more.

This most likely signifies that Broadcoms dividend will keep on to see significant costs of advancement amid really sensible payout ratios.

Despite a powerful quarter and future outlook, shares are investing incredibly shut to the two the historical various and its intrinsic value. Broadcoms organization product and dividend make the name an best select for individuals wanting for know-how exposure.

This posting 1st appeared on GuruFocus.

[ad_2]

Source connection