General Mills Offers Nice Dividend Yield Despite Valuation Concerns

[ad_1]

Wolterk/iStock Editorial via Getty Images

By Brian Nelson, CFA

From where we stand, bellwethers in the consumer staples sector (VDC) can’t price successfully ahead of inflationary headwinds, and many are experiencing tremendous gross margin pressure. Not only this, but also in many cases, we think branded staples are experiencing demand (volume) destruction as consumers balk at price increases that still fall short of offsetting the heightened cost environment.

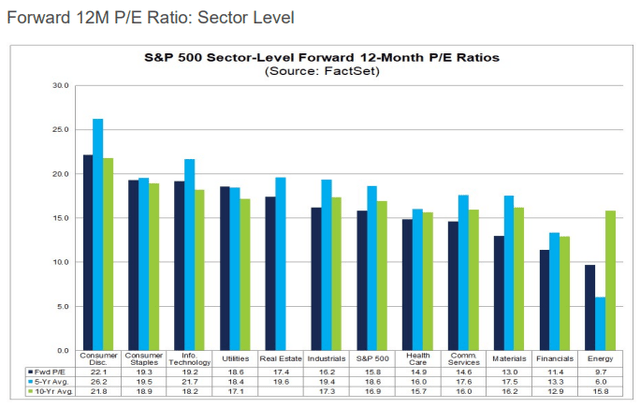

Many consumer staples equities have huge net debt positions and hefty dividend obligations, too, and while many of the types of products they produce consumers cannot do without, we think we might see the consumer staples group’s share prices come under continued pressure in this market environment and eventually fetch what we think would be a market multiple (roughly three turns of earnings lower, or ~19x earnings to ~16x earnings).

Consumer staples entities are trading at ~19.3x forward earnings, well above that of the average S&P 500 company of 15.8x forward numbers. (Image Source: FactSet)

Even if consumer staples names do not sell off to garner a market multiple, however, there still appears to be some tough sledding ahead on a fundamental basis given their report commentary, and we’ll look to evaluate our newsletter portfolios and their exposure to the consumer staples arena in the coming weeks to months. What remains clear is that the outlook for many consumer staples entities is not pretty, and a company such as General Mills (NYSE:GIS) is not immune to the sector’s troubles.

In late March, General Mills reported its fiscal 2022 third-quarter results for the period ending February 27, 2022, noting that it had experienced pressure on gross margins to the tune of 350 basis points, pointing to “higher input costs and unfavorable mark-to-market effects, partially offset by favorable net price realization.” General Mills did raise its outlook for organic sales and constant currency adjusted operating profit when it released its latest results, but the market will get a better read on just how painful input cost inflation may be in its next fiscal year when the firm reports its fiscal fourth quarter performance June 29. The company’s fiscal fourth quarter results will cover the months March through May.

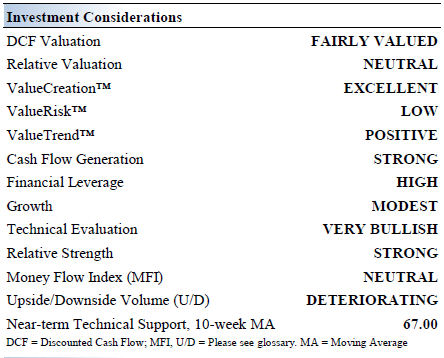

General Mills’ Investment Considerations

The key investment considerations we look for when evaluating General Mills. (Image source: Valuentum)

General Mills has a distinguished portfolio of leading brands, including Cheerios, Betty Crocker, Pillsbury, Yoplait, Nature Valley, Old El Paso and Häagen-Dazs. The firm also owns Blue Buffalo, a leading pet food and nutrition company. Roughly 80% of its sales come from North America. It was founded in 1928 and is headquartered in Minneapolis, Minnesota.

In November 2021, General Mills sold its 51% interest in Yoplait S.A.S to Sodiaal. In return, General Mills received full ownership of the Canadian Yoplait business and reduced royalty rates on the Yoplait and Liberté brands in the US and Canada.

General Mills acquired Blue Buffalo Pet Products in April 2018 for ~$8 billion, one of the best brands in the industry. This acquisition was pursued so General Mills could capitalize on the “humanization of pets” trend in the US and improve its long-term growth outlook. In July 2021, General Mills acquired Tyson Foods (TSN) pet treats business for ~$1 billion.

General Mills plans to grow its net organic sales by ~2%-3% annually, steadily expand its margins, and grow its adjusted diluted EPS by mid-to-high-single-digits annually over the long haul. The firm aims to convert at least 95% of its adjusted earnings into free cash flow over the long term.

The near term may not be rosy for General Mills. In its third-quarter fiscal 2022 results for the period ending February 27, 2022, the company’s operating profit declined 1%, even as organic net sales advanced 4%. The company’s outlook for the remainder of fiscal 2022 also showed that it’s unable to leverage sales expansion into faster earnings growth. For fiscal 2022, management noted that constant-currency adjusted operating profit will be down 2% to flat, while organic net sales are expected to leap 5%.

General Mills dominates the US cereal market with brands such as Cheerios, Lucky Charms, and Cinnamon Toast Crunch. In the near-term, cost inflation headwinds are building across the board which the firm seeks to offset via price increases, to a degree. Here is what management had to say about cost pressures when it reported in March: “For the full year (2022), the company continues to expect input cost inflation of 8 to 9 percent and significant costs related to supply chain disruptions.” Fiscal 2023 could be a difficult one for the company.

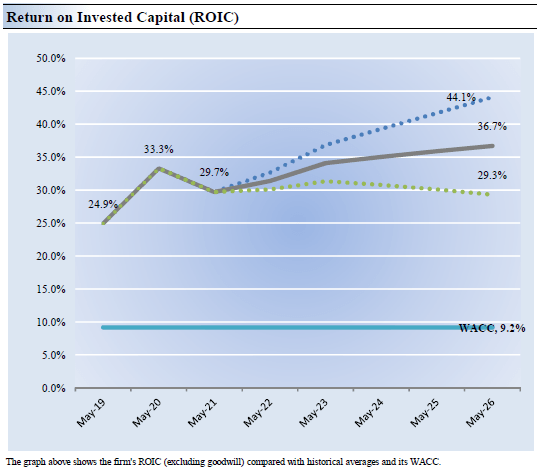

General Mills’ Economic Profit Analysis

The best measure of a company’s ability to create value for shareholders is expressed by comparing its return on invested capital with its weighted average cost of capital. The gap or difference between ROIC and WACC is called the firm’s economic profit spread. General Mills’ 3-year historical return on invested capital (without goodwill) is 29.3%, which is above the estimate of its cost of capital of 9.2%.

As such, we assign General Mills a ValueCreation rating of excellent. In the chart below, we show the probable path of ROIC in the years ahead based on the estimated volatility of key drivers behind the measure. The solid grey line reflects the most likely outcome, in our opinion, and represents the scenario that results in our fair value estimate. Despite cost pressures, we still expect General Mills to generate value for shareholders.

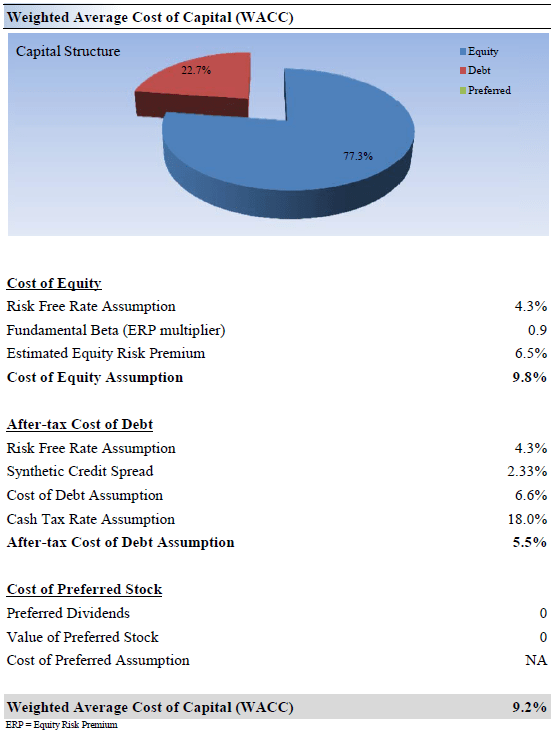

We expect General Mills to continue to generate economic profits despite inflationary pressures. (Image source: Valuentum) How we calculate General Mills’ weighted average cost of capital assumption. (Image Source: Valuentum)

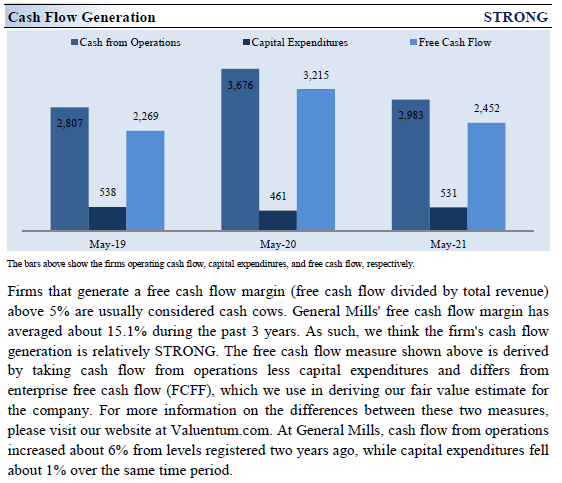

General Mills’ Cash Flow and Valuation Analysis

General Mills is a fantastic free cash flow generator. (Image source: Valuentum)

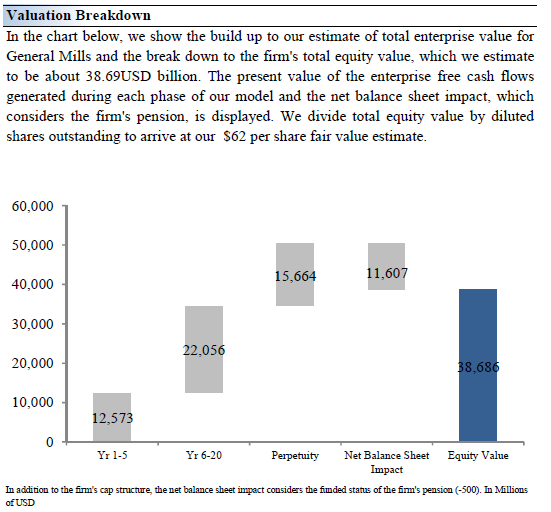

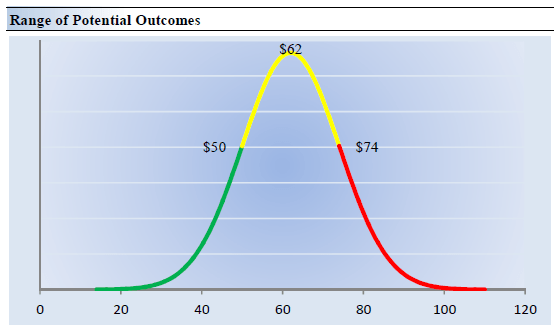

We think General Mills is worth $62 per share, with a fair value range of $50-$74 per share. The margin of safety around our fair value estimate is driven by the firm’s LOW ValueRisk rating, which is derived from an evaluation of the historical volatility of key valuation drivers and a future assessment of them.

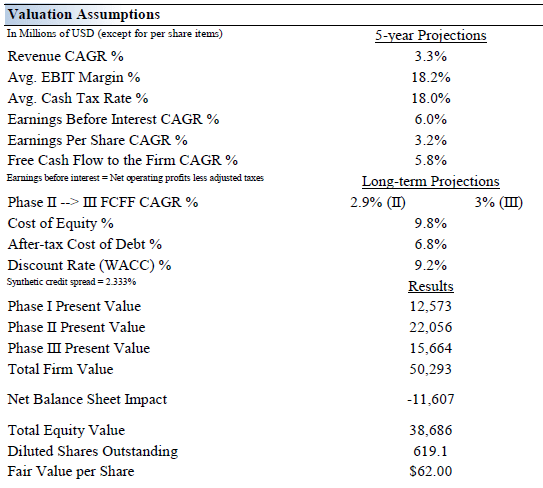

Our near-term operating forecasts, including revenue and earnings, do not differ much from consensus estimates or management guidance. Our model reflects a compound annual revenue growth rate of 3.3% during the next five years, a pace that is lower than the firm’s 3-year historical compound annual growth rate of 4.8%.

Our valuation model reflects a 5-year projected average operating margin of 18.2%, which is above General Mills’ trailing 3-year average. Beyond year 5, we assume free cash flow will grow at an annual rate of 2.9% for the next 15 years and 3% in perpetuity. For General Mills, we use a 9.2% weighted average cost of capital to discount future free cash flows.

The key valuation assumptions that drive our fair value estimate of General Mills. (Image source: Valuentum) The duration of value composition for General Mills, on the basis of our discounted cash flow process. (Image source: Valuentum)

General Mills’ Margin Of Safety Analysis

The fair value estimate range for General Mills. The highest point on this probability distribution represents the company’s most likely ‘true’ fair value. (Image source: Valuentum)

Our discounted cash flow process values each firm on the basis of the present value of all future free cash flows. Although we estimate General Mills’ fair value at about $62 per share, every company has a range of probable fair values that’s created by the uncertainty of key valuation drivers (like future revenue or earnings, for example). After all, if the future were known with certainty, we wouldn’t see much volatility in the markets as stocks would trade precisely at their known fair values.

Our ValueRisk rating sets the margin of safety or the fair value range we assign to each stock. In the graph above, we show this probable range of fair values for General Mills. We think the firm is attractive below $50 per share (the green line), but quite expensive above $74 per share (the red line). The prices that fall along the yellow line, which includes our fair value estimate, represent a reasonable valuation for the firm, in our opinion.

Concluding Thoughts

The strength of General Mills lies in the brand recognition of its portfolio as it dominates the U.S. cereal market and has a strong position in the U.S. pet food space. General Mills and its predecessor company have paid out dividends without interruption for 120+ years. Over the long haul, General Mills aims to convert at least 95% of its adjusted earnings into free cash flow and plans to return 80%-90% of its free cash flows to shareholders in the form of dividends and stock repurchases.

Forecasted margin expansion and organic net sales growth are expected to drive the firm’s adjusted diluted EPS higher by mid-to-high-single-digits annually over the long term, but the near term will be choppy. We wouldn’t be surprised if management guides fiscal 2023 revenue meaningfully higher due to pricing initiatives but operating profit to be down 2% to flat due to severe cost headwinds, much like it has done for fiscal 2022. Bottom-line consensus estimates for fiscal 2023 may be a bit too high at the moment.

Though we like the steady operations and free cash flow generating abilities of General Mills, its best dividend growth days are likely behind it. The firm’s net debt position weighs on its Dividend Cushion ratio and could be a cause for concern down the road. Competing capital allocation options could provide resistance to the pace of dividend growth. It is likely General Mills will pursue significant acquisitions in the future to enhance its growth prospects, acquisitions that will likely be funded by the balance sheet. While we approve of General Mills’ past deleveraging activities, we would prefer to see its net debt load move lower still.

Though shares are not materially mispriced, we could see General Mills’ equity trade down to our $62 per share fair value estimate as investors evaluate the near-term pressure on its operating profit and reevaluate accordingly. Shares are trading in the high-$60s at the moment. Still, despite the many moving parts and inflationary pressures, investors get paid a nice 3% dividend yield to wait for better times at General Mills.

This article or report and any links within are for information purposes only and should not be considered a solicitation to buy or sell any security. Valuentum is not responsible for any errors or omissions or for results obtained from the use of this article and accepts no liability for how readers may choose to utilize the content. Assumptions, opinions, and estimates are based on our judgment as of the date of the article and are subject to change without notice.

[ad_2]

Source link

.png)